印度尼西亚¶

电子发票模块¶

电子发票模块 随印度尼西亚本地化模块默认安装。它允许为一个税务发票或一批税务发票生成 CSV 文件,以上传到 税务局电子发票 应用程序。

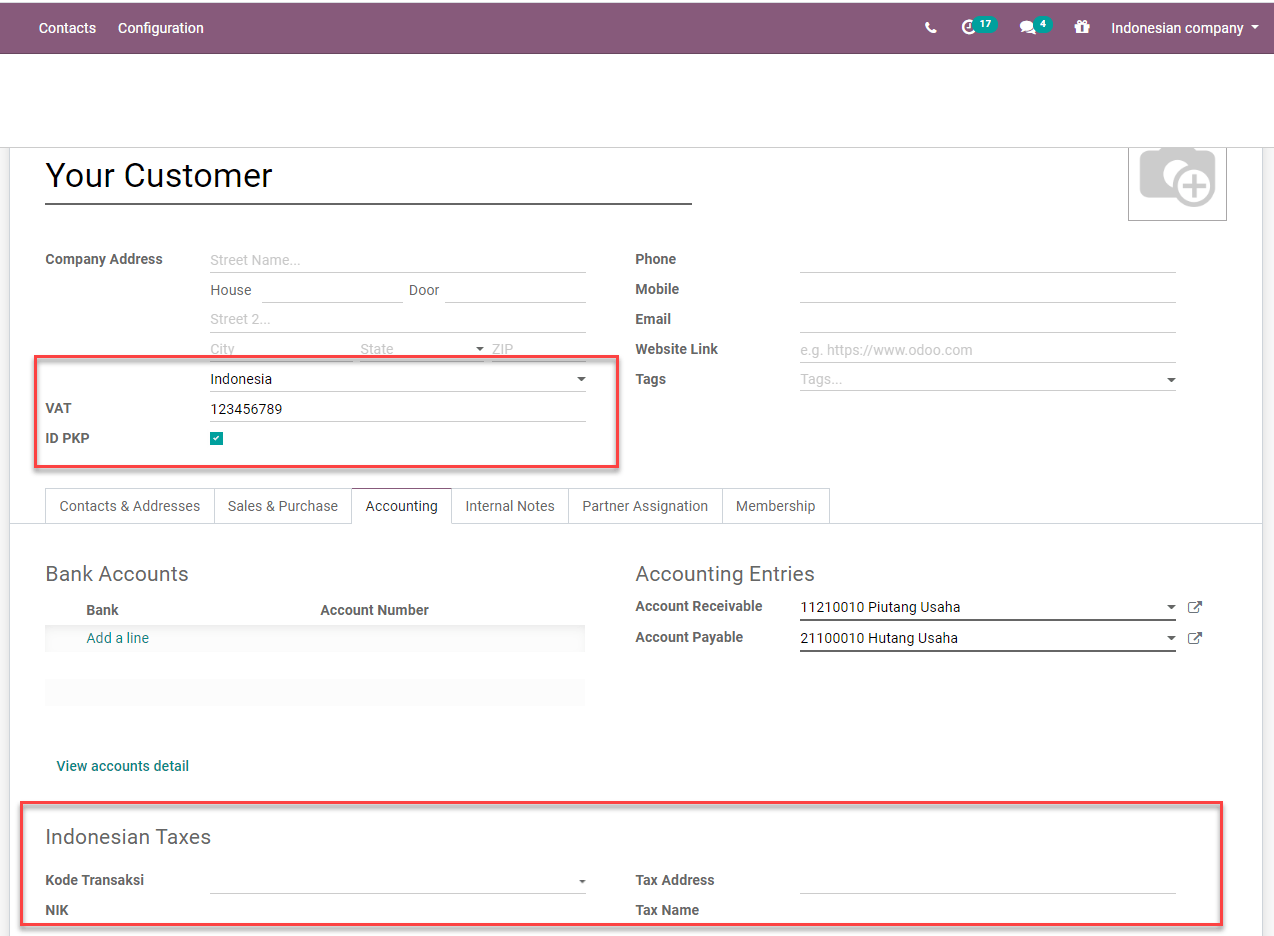

NPWP/NIK 设置¶

- 您的公司此信息用于效果文件格式中的 FAPR 行。您需要在 Odoo 公司的相关合作伙伴上设置增值税号。如果不设置,将无法从发票创建电子发票。

- 您的客户您需要勾选 ID PKP 复选框以为客户生成电子发票。您可以使用客户联系人上的增值税字段设置生成电子发票文件所需的 NPWP。如果您的客户没有 NPWP,只需在相同的增值税字段中输入 NIK。

用法¶

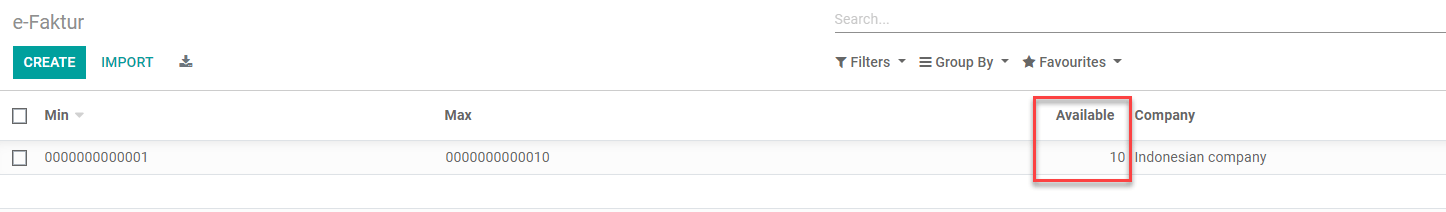

生成税务发票序列号¶

转到 。为了能够将客户发票作为电子发票导出给印度尼西亚政府,您需要在此处输入政府分配给您的号码范围。当您验证发票时,将根据这些范围分配一个号码。之后,您可以在发票列表中筛选仍需导出的发票,然后单击 操作 ,再单击 下载电子发票 。

从印度尼西亚税务局收到新的序列号后,您可以通过此列表视图创建一组税务发票序列号组。您只需指定每个序列号组的最小值和最大值,Odoo 将自动将号码格式化为 13 位数字,如印度尼西亚税务局所要求。

有一个计数器告知您该组中剩余多少未使用的号码。

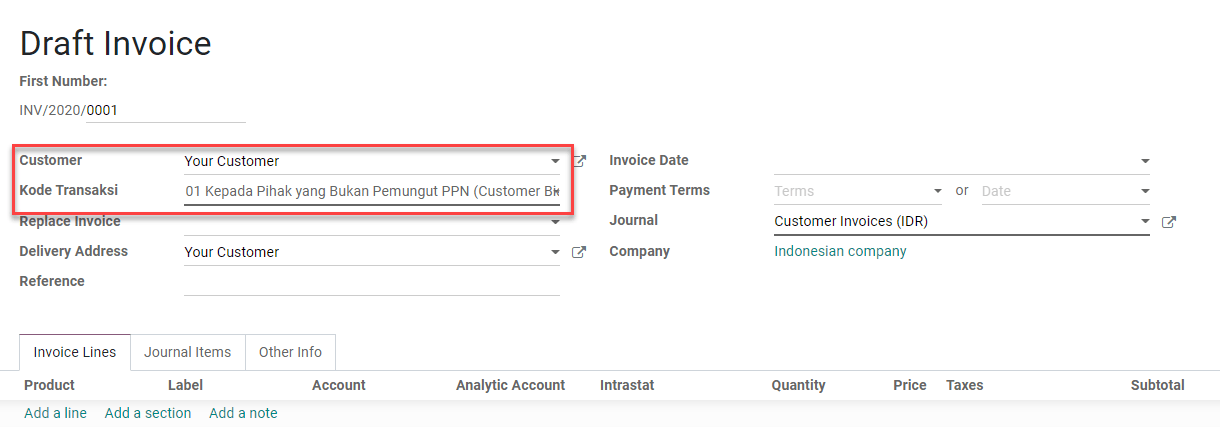

为单个发票或批量发票生成电子发票 CSV¶

从 创建发票。如果发票客户的国家是印度尼西亚且客户设置为 ID PKP ,Odoo 将允许您创建电子发票。

为电子发票设置交易代码。交易代码和应用于发票行的增值税类型存在相关约束。

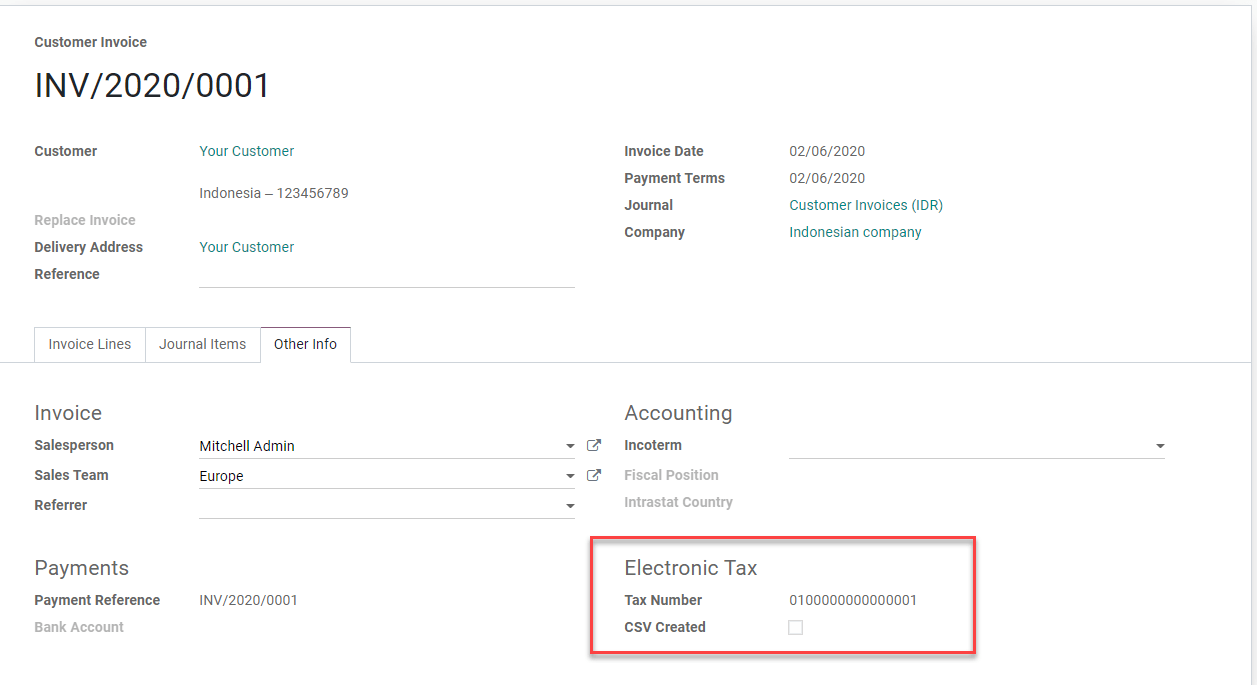

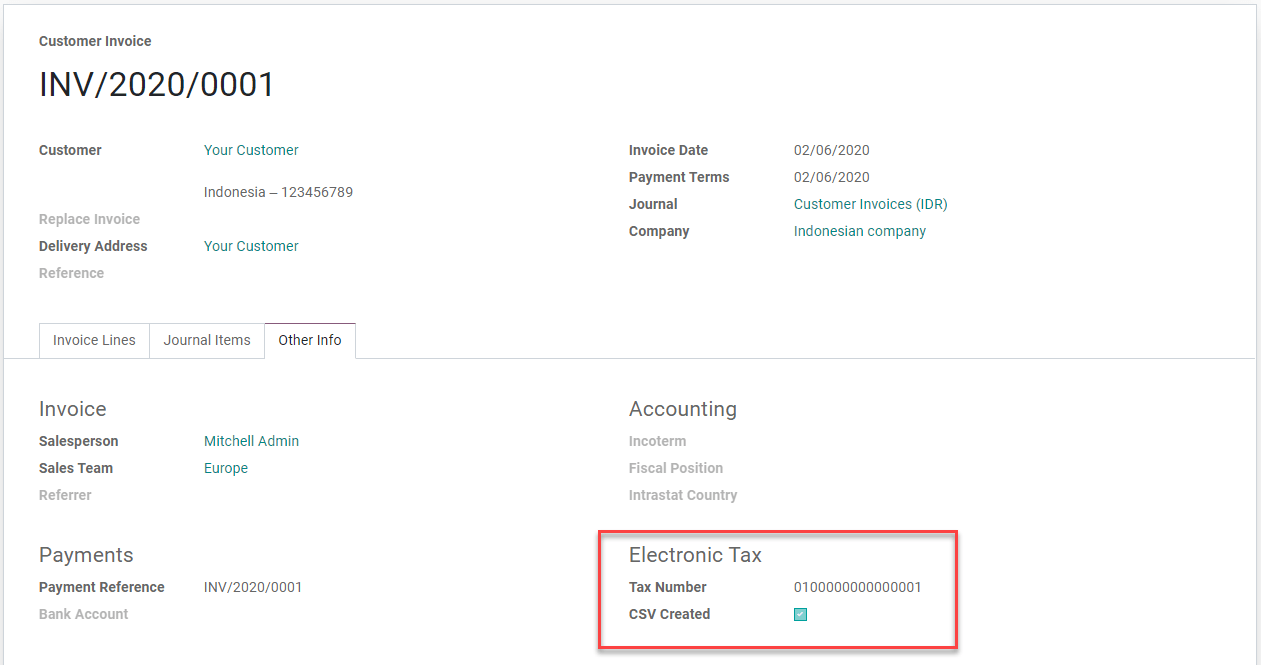

Odoo 将自动从电子发票号码表中选取下一个可用的序列号(参见 上文部分 ),并将电子发票号码生成为交易代码和序列号的连接。您可以从发票表单视图的 额外信息 页面下的 电子税务 框中看到这一点。

发票过账后,您可以从 操作 菜单项 下载电子发票 生成并下载电子发票。复选框 CSV 已创建 将被设置。

您可以在列表视图中选择多个发票并生成批量电子发票 .csv。

交易代码(Transaction Code)¶

生成电子发票时可用的代码如下: - 01 给非增值税征收方(普通客户) - 02 给财政官员征收方(政府部门) - 03 给非财政官员征收方(国有企业) - 04 其他价值的 DPP(增值税 1%) - 06 其他交付(外国游客) - 07 不征收增值税的交付(经济特区/巴淡岛) - 08 免征增值税的交付(特定商品进口) - 09 资产交付(增值税法第 16D 条)

更正已过账并下载的发票:替换发票功能¶

在 Odoo 中取消原始错误发票。例如,我们将把 INV/2020/0001 的交易代码从 01 更改为 03。

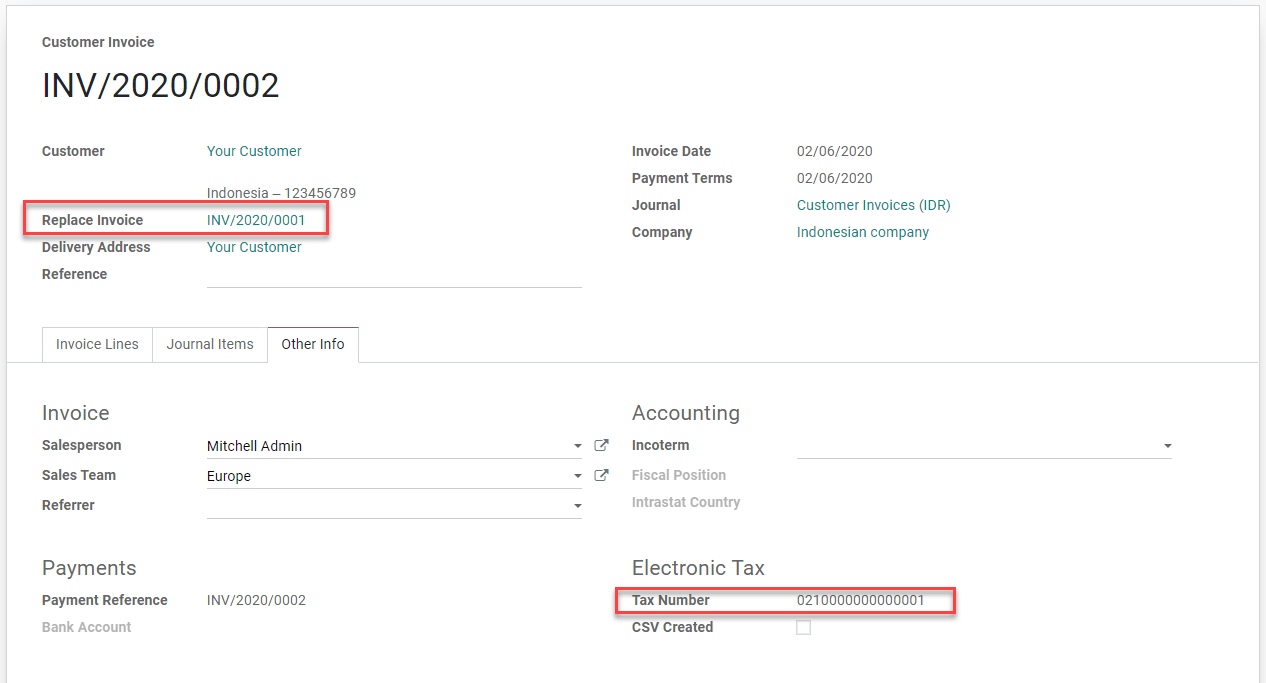

创建新发票并在 替换发票 字段中设置已取消的发票。在此字段中,我们只能选择同一客户的 取消 状态发票。

当您验证时,Odoo 将自动使用与已取消和替换发票相同的电子发票序列号,并将原始序列号的第三位数字替换为 1 (如电子发票应用程序中上传替换发票的要求)。

更正已过账但尚未下载的发票:重置电子发票¶

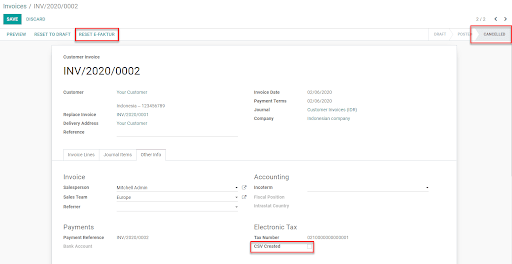

将发票重置为草稿并取消它。

在发票表单视图上单击 重置电子发票 按钮。

序列号将被取消分配,我们将能够将发票重置为草稿、编辑它并重新分配新的序列号。

发票上的 QRIS 二维码¶

QRIS 是一种数字支付系统,允许客户通过扫描他们喜欢的电子钱包中的二维码进行支付。

重要

根据 QRIS API 文档 ,QRIS 在 30 分钟后过期。由于此限制,二维码不包含在发送给客户的报告中,仅可在客户门户上使用。

激活二维码¶

转到 。在 客户付款 部分下,激活 二维码 功能。

QRIS 银行账户配置¶

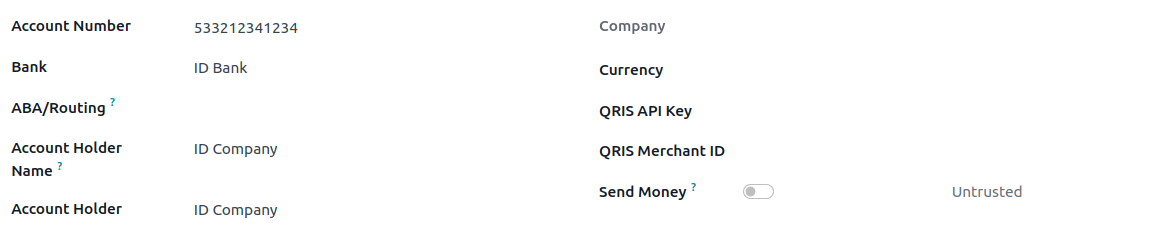

转到 并选择要激活 QRIS 的银行账户。根据 QRIS 提供的信息设置 QRIS API 密钥 和 QRIS 商户 ID 。

重要

账户持有人的国家必须在其联系人表单中设置为 印度尼西亚 。

参见

银行日记账配置¶

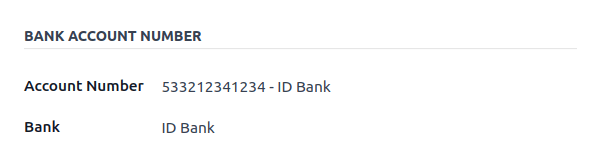

转到 ,打开银行日记账,然后在 日记账分录 标签页下填写 账号 和 银行 。

使用 QRIS 二维码开具发票¶

创建新发票时,打开 其他信息 标签页并将 付款二维码 选项设置为 QRIS 。

确保 收款银行 是您配置的银行,因为 Odoo 使用此字段生成 QRIS 二维码。